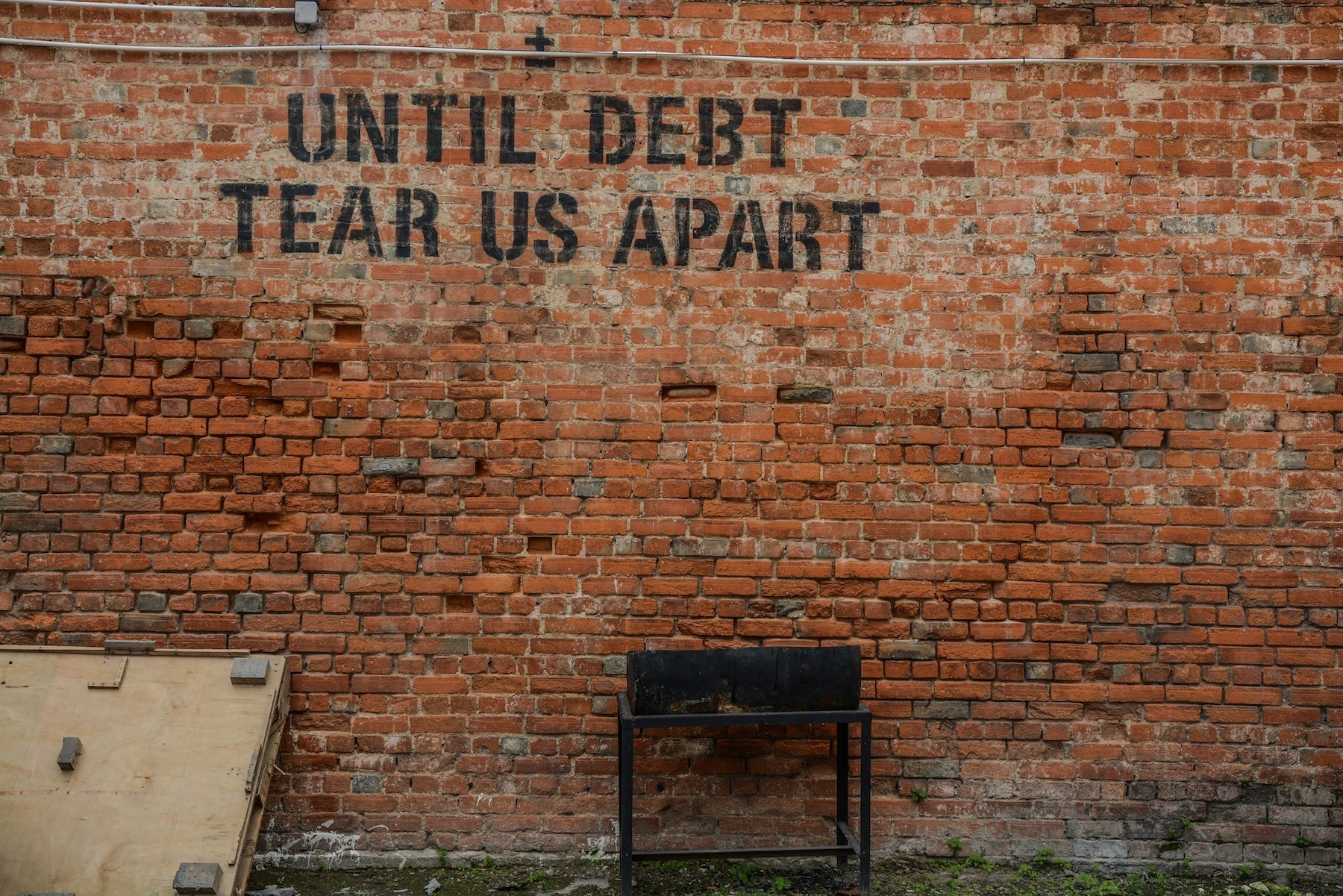

In today's world, achieving financial independence is essential. Equipping yourself with vital financial knowledge and skills becomes paramount. As the saying goes, "knowledge is power," and when it comes to finances, this couldn't be more accurate. Let's delve into how you can empower yourself financially, paving the way for long-term security and independence.

Dame Stephanie Shirley, a prominent figure in the UK tech industry says, "Surviving requires us to be informed, thoughtful, and well-motivated." This wisdom holds true in the realm of personal finance. Educating yourself about budgeting, investing, and managing debt lays the groundwork for sound financial decision-making.

Take inspiration from the teachings of Martin Lewis, the consumer champion known for demystifying complex financial concepts. His emphasis on budgeting and cutting unnecessary expenses resonates deeply in the quest for financial stability. Tracking your spending and prioritizing needs over wants are fundamental steps towards building a solid financial foundation.

Harnessing the power of compound interest, as advocated by Warren Buffett, can significantly impact your financial independence journey. By starting early and consistently investing in assets that generate compound returns, you set yourself on the path to wealth accumulation. Remember Buffett's timeless advice: "The best investment you can make is in yourself."

Sarah Pennells, the finance expert behind SavvyWoman.co.uk, emphasizes the importance of financial resilience. Building an emergency fund to weather unexpected expenses or income disruptions provides a safety net during challenging times. As Pennells puts it, "Having a financial buffer gives you the freedom to make choices that are right for you."

However, financial empowerment goes beyond individual gain; it fosters community resilience and societal progress. Echoing the sentiments of Maya Angelou, who once said, "When we give cheerfully and accept gratefully, everyone is blessed," consider giving back to your community.

Cultivating a culture of financial literacy and generosity enriches not only your life, but also the lives of those around you.

In conclusion, empowering yourself with essential financial knowledge and skills is not merely about accumulating wealth. It's about securing your future and contributing to a brighter tomorrow.

By heeding the advice of these influential figures and taking proactive steps towards financial well-being, you pave the way for a life of security, independence, and fulfillment.